MINERAL RESOURCES

METAL OF THE FUTURE

MINERAL RESOURCES

Ilmenite

A major raw material used in the manufacturing of titanium pigments and metals

A major Iron Ore mineral used as a feedstock for steel production. Also used as a heavy medium in the coal washing

Used in the ceramics and chemical industries, it is also, increasingly, being used in the manufacture of high strength alloy.

Mineral composed of silica, aluminium and alkali elements. Feldspar is mainly used in glass manufacturing

A natural source of phosphate for phosphoric fertilizers and animal feed. Demand for natural agricultural products

Is with the exception of diamond, the hardest mineral known and is used as a high quality abrasive

Is the most abundant of three naturally occurring forms of titanium dioxide. Commercially important titanium mineral

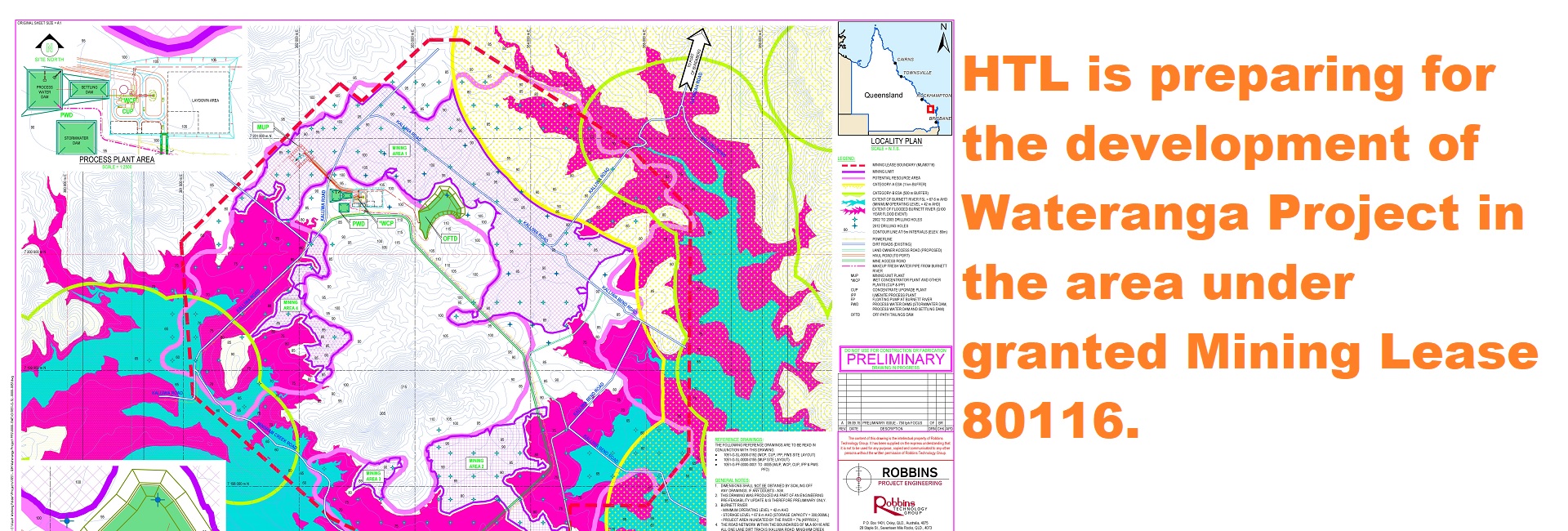

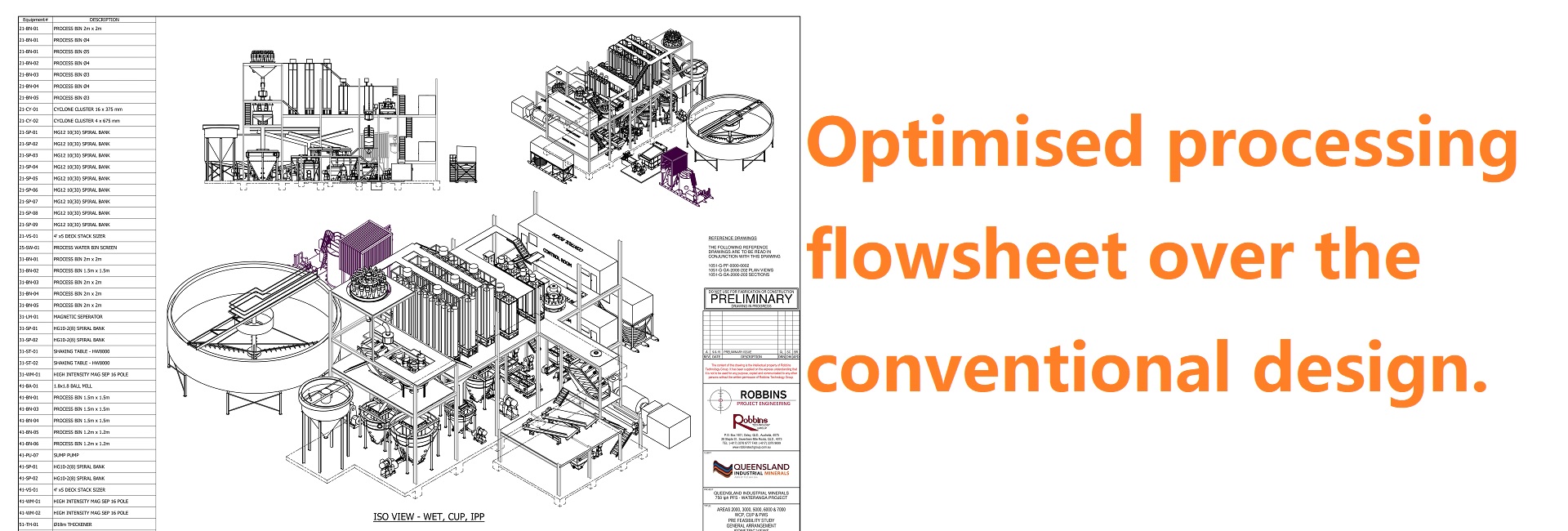

High Titanium Resources and Technology Limited (“HTL”), formerly Queensland Industrial Minerals Ltd (“QIM”), is a public company established on 31st October 2002 for developing a mineralized area known as ‘Wateranga’ under Exploration Permit Minerals (“EPM”) 13278.

The Wateranga project covers an area of approximately 8,038 hectares and is located approximately 80km southwest of Bundaberg, in south east Queensland. The focus of the current economic interest is an eluvial resource derived from weathered gabbro, which contains valuable minerals. The main focus of the project is ilmenite, but other potentially valuable minerals include feldspar , apatite, mica and zircon.

Mining Lease ML80116 of central target area has been granted in 2018, and the project is moving to production stage.

HTL develops steadily since the company established. Creating long-term shareholder value is always HTL’s priority. We commit to work in ways that are consistent with our values of integrity, performance and teamwork. HTL board members believe that as Wateranga Project will gradually move into production stage from 2021-2022 financial year, HTL will become emerging force in the industrial minerals industry, with supplying Australian and International market ample amount of high quality industrial minerals in the following 30 to 40 years. Meanwhile to accomplish HTL’s ultimate mission that is to output long-term values to shareholders, employees and local communities.

Dear Shareholders, HTL AGM 2022 Notice has been posted on Thursday 02 May 2024, please note to check. AGM 2022 will be held at 10.00 am on Friday 24 May 2024 at the registered office of the Company at...

Dear Shareholders We are pleased to inform you that during the Extraordinary General Meeting (EGM) held on Wednesday 12 April, the resolution to approve the Board of Directors to enter into equity inv...

Dear Shareholders, I am pleased to inform you that the board of directors has appointed Eric Chen as additional company secretary of HTL. This appointment is effective from 1 March 2023. Eric Chen has...

ACTIVITY REPORT

Port infrastructure upgrade (01/03/2024)

The $21 million project of a 250-metre-long conveyor belt at the Port of Bundaberg was completed in August last year, and commissioning was successful afterwards. It will allow a wider range of products to be loaded from the port at a much faster rate, including HTL’s ilmenite for exporting. Recently common user stockpile on port construction has commenced and it will benefit all port users for faster loading at lower cost.

Further exploration plan (23/05/2023)

HTL has received exploration proposal for the northern area of the tenement. The proposal includes two stage of works. 50 drillings will be completed for stage 1 to produce a report of drilling results. Potential gold and copper mineralisation will also be target of the exploration.

Mineral Resource Estimate & Valuation (07/11/2022)

Mineral Resource Estimate & Valuation report has been completed by MEC Mining. The resource of Wateranga Project has been remodelled with resource valuation increased by more than 20% comparing to the earlier valuation report. The main reasons are the substantial increase of ilmenite price and the exchange rate changes.

Haulage route optimization (30/09/2022)

Meeting was organized between HTL, North Burnett Regional Council, Department of Transport and Main Roads and Department of State Development recently to discuss HTL’s plan of optimizing haulage route to reduce logistic cost. Update had been given to all involved parties about how we plan to shorten the haulage time. Feedback has been received that 19m B-double operation is permitted with current road condition.

Mine site visit (21/09/2022)

As the financing of the project is expected to be finalized in the near future, we visited our mine site and Port of Bundaberg in preparation of incoming site development. Meeting was arranged on site and port respectively to optimize mine plan and logistic. HTL also followed up with local council, Department of Transport and Main Roads and Department of State Development to give update on schedule of our development. HTL has been advised that our project development will be strongly supported by the department.

MARKET UPDATES

Ilmenite market maintains a stable high price, while downstream markets continue to grow(16/10/2023)

Since the second half of 2021, the price of 50A-quality ilmenite has been maintained at a high level of over $400 per ton for nearly two years. The latest report on the Chinese downstream titanium dioxide market in August 2023 shows an import volume of approximately 9,210 tons, with a month-on-month growth of 14.87%. The export volume is 137,480 tons, with a month-on-month growth of 1.19%. The domestic total production is approximately 346,140 tons, with a month-on-month increase of 20.67%. Apparent consumption stands at 217,869 tons, with a month-on-month increase of 37.02%.

China C919 flying titanium alloy high(08/06/2023)

Recently, the C919 airliner completed its first commercial flight. The amount of titanium alloy on the C919 aircraft reaches 9.3% of the weight of the fuselage structure, far exceeding the 4% of the Boeing 737 and the 4.5% of the Airbus A320 in the same class. The self-weight of the C919 is about 42 tons, which means that nearly 4 tons of titanium alloy are used on one C919.

Ilmenite market size is set to grow at an impressive pace in the upcoming years till 2028(06/06/2023)

Recent market report indicates that the global Ilmenite market size was valued at USD 2147.31 million in 2022 and is expected to expand at a CAGR of 13.09% during the forecast period, reaching USD 4492.42 million by 2028.

Australia’s 2022 Critical Minerals Strategy will grow our critical minerals sector (12/04/2022)

Resources Minister Keith Pitt has announced funding to unlock potential of critical minerals sector:

A link to the Critical Minerals Strategy is below:

2022 Critical Minerals Strategy | Department of Industry, Science, Energy and Resources

As part of Wateranga Project’s target minerals, titanium is listed as a critical mineral in the strategy, as well as scandium and zirconium.

Please fill in the form below if you have any comments or questions concerning this site or HTL. This will automatically send a message to our preferred email address:

7 Nelson Road

Yennora NSW 2161

T: +61 2 9721 3931

F: +61 2 9632 4460